Yesterday was a money speculator's party. Luna plummeted from the highest 110 to 0.001 in just three days. Some people were happy and others were worried. My friends made hundreds of thousands of short profits, and some lost a year's income. The sheep kicked the wool before it was collected. When everyone focused on scolding Luna, the hunters in the dark forest had quietly made $10 million in other ways.

After getting up this morning, I saw someone forwarding the news that Venus lost $10 million due to the suspension of price update of chainlink. Many readers asked me to help analyze the context of this matter.

Let's first disassemble the keywords of the above news: vneus, chainlink and price update. We should first understand the meaning of these three keywords, and then sort out what happened between them.

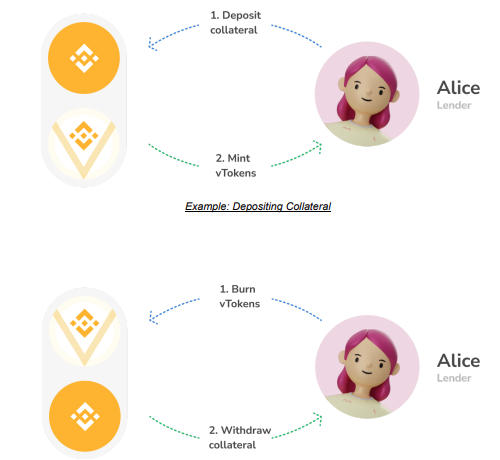

Venus is a loan agreement platform on the BSC of Qian'an. The development team behind it was acquired by Qian'an. When you have idle tokens in your account, you can mortgage them in Venus to obtain interest income. When you mortgage a token, Venus will Mint out the equivalent vtoken. You can interpret it as a receipt. Then, when you want to take back your mortgage assets, you can burn the vtoken in Venus in exchange for the token originally mortgaged.

Just now, we are talking about the scenario of mortgage assets saving money to earn interest. Similarly, you can also borrow money from Venus. The premise is that you need to mortgage one token first, and then you can lend another token with a maximum value of 75% of the collateral, and you need to pay interest. For example, if I mortgage BTC with a value of 10000 US dollars, you can lend other currencies with a maximum value of US dollars, but if the total value of your collateral is less than 75% due to price fluctuations, If you lend 75% of other currencies, you may be forced to liquidate.

Well, we understand the principle of Venus. Next, let's see what chainlink is and what role it plays in this profit event.

Users can borrow up to 75% of the total value of collateral from Venus, which means that the value of the current collateral needs to be calculated when borrowing. This calculation process uses a thing called band oracles Oracle, which sounds like a great name. In fact, it is a third-party data processing and retrieval tool to transfer some off chain data back to the chain according to the request of the smart contract.

The Oracle used by Venus is chainlink. When a user borrows money, chainlink will first obtain the latest price of the user's mortgaged assets, and then send it to Venus smart contract, so that it can judge how much money the user can borrow.

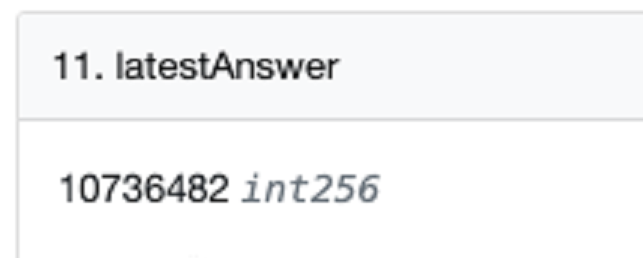

We can see from the contract that the current latest quotation for Luna is 10736482, which uses eight decimal places, that is, the minimum unit is US $0.00000001, so the quotation converted into US dollars is US $0.107 per Luna.

Wait, $0.107? Isn't Luna already falling to several zeros of the decimal point? Why is it still $0.107?

The problem is that chainlink returned the wrong price. Instead of updating the latest Luna price, it stuck at $0.1.

There are 25 kinds of mortgage tokens that Venus can accept, that is, Venus doesn't collect all garbage, so it sets a minimum price of $0.1 for a token. I think the 25 high-quality assets I have carefully selected will not fall below $0.1. As a result, I didn't think there was really one, Luna.

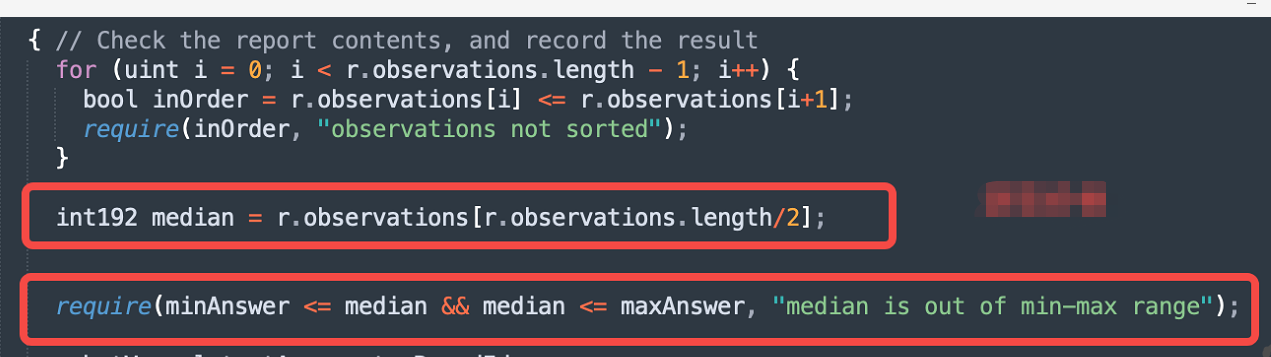

First, let's take a look at how the contract code updates the real-time price. Among them, median obtains the price through the Oracle, and then a verification is carried out below. Only the price between minanswer and maxanswer is valid and can be updated, otherwise it will not be updated.

What is minanswer? The minimum result set in the contract is $0.1.

Do you understand? When the actual price is lower than US $0.1, it will not be updated to the effective price, resulting in the last wipe of the edge of US $0.1. After 0.107 is updated, it will be stuck here and cannot continue to follow the latest price.

What does it mean that the price is not updated? Big fat sheep can collect. I can pledge Luna to the platform at a price much lower than 0.1, but the platform will give me a valuation at the price of 0.1, and then I will lend other tokens at the valuation of 0.1. This operation will make a steady profit

Let's take a look at what a successful user has done. First, he spent $100000 to exchange busd for six million Lunas. At that time, the price of each Luna was 0.014. At this time, the price of the Oracle is nearly 10 times the actual price.

Then he continued to buy a large number of Luna at a low price, and then pledged them all to Venus and lent $1.1 million busd.

He has made a total of 30 such borrowing behaviors, with a minimum of 100000 and a maximum of 1 million each time. He has collected about $5 million in total. This is not as simple as collecting wool. It is to directly open a textile factory.

This arbitrage is different from that mentioned in the previous article. It doesn't need any technical means. The profit of human flesh manual operation is ten times that of one in and one out. The key is that hidden bugs are difficult to be found, and even if they are found, they can't be used until Luna is an extreme case. So I guess he may have found these bugs long ago, but he is very patient and has been waiting for opportunities. Finally, Luna appears one day, So he made a decisive move to achieve sniping.

Note that Venus has patched the vulnerability and can not continue arbitrage.